canadian tax strategies for high income earners

Also if youre planning on being a high income earner in your retirement then an rrsp might not be as beneficial to you as youll still be taxed in a high tax bracket. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Throwback Thursday University Education In 1965 Vs 2015 Education University Post Secondary Education

For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep.

. Tax Planning Strategies for High-income Earners. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans RESPs and Tax-free Savings Accounts TFSAs.

Tax Saving Strategies for High-Income Earners. Business owners hire your kids. Having the higher income earner pay family expenses.

High income earners may find at some point in their career that RRSPs may leave too much wealth exposed to tax. These changes are significant because they make it possible for high-income earners to make additional contributions to a retirement plan during the tax year. Tax minimization strategies for individuals Income splitting with family members Family income splitting is a fundamental tax planning strategy but many Canadians are not.

Just as your ambitions are uniquely your own so too is your tax situation. Formerly known as the Working Income Tax Benefit WITB the Canada Workers Benefit CWB is a refundable tax credit for Canadians with a low income. If you run a business are self-employed or doing freelance and contract work its worth considering incorporation.

The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government. Your RRSP limit for the current year 2018 is shown on your 2017 Notice of Assessment. Canadas highest income earners those in the top 10 are paying effective tax rates of 25 to 40.

Tax deductions are expenses that can be deducted from your taxable income. Tax planning for high. Income splitting with family members is a simple and effective tax planning strategy.

Income Distribution in Canada by Age. The government is not against helping tax payers minimize their tax bills legally. Typically the RRSP is more beneficial to higher-income earners.

Contributions to an RRSP lower your taxable income. No single tax strategy will fit all scenarios. Tax-sheltered accounts are extremely useful because they help you delay reduce or even avoid paying taxes all together.

Change the Character of Your Income. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

RRSP limit for the year. A 250 headline rate for non-trading income or also called passive income in the Irish tax code. In contrast the bottom 50.

Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible individual pension plans. Loaning funds at the prescribed rate of interest to a spouse 1. Like most other places if you live or earn income in Canada you will have to pay income tax.

If you need to pay for your childrens post-secondary education you should. Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible individual pension. Canadian Tax Tricks.

Those who qualify will receive 26 of every dollar they make over 3000 up. Instead your tax obligations may require a personalized guiding plan with annual tinkering and consultations with tax advisors as your wealth. Knowing the right tax reduction strategies for high-income earners is key to lowering your income.

The more money you make the more taxes you pay. Canadian tax law allows for several ways to reduce your taxes owed if you know the current rules and. The contribution you will make.

Taking advantage of all of your allowable tax deductions and credits. For example on the household level two income earners may combine their wages to afford a car. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

For many high-earning Canadians there may be specialized tax strategies that help preserve and grow their wealth. One way to reduce your tax burden is to change the character of your income. The math is simple.

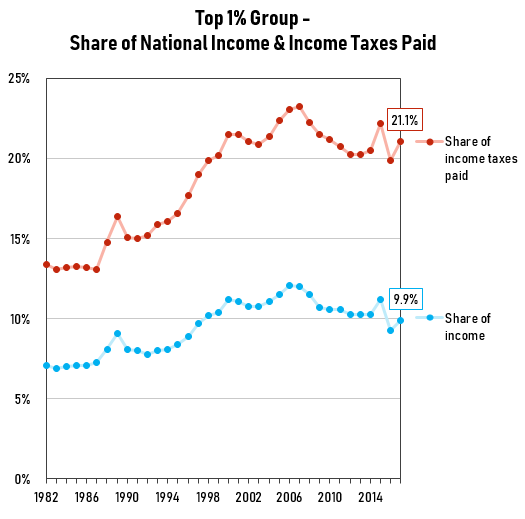

Im in the top 1 of income earners in Canada and much of my income this year will be taxed at the top nominal rate for Ontarians 5353. Using the benefits of a registered education savings plan RESP or registered disability savings plan RDSP Investing child tax benefit money in the childs name. RRSP contributions are tax deductible and any income and gains earned inside a RRSP are not taxable.

For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is. With your qualified tax advisor. As a refresher for 2021 fy the individual tax rates including medicare levy are.

Individuals making between 3000 to 24112 and families with incomes below 36482 are eligible for the tax credit. Income splitting and trusts. Making a gift to an adult family member.

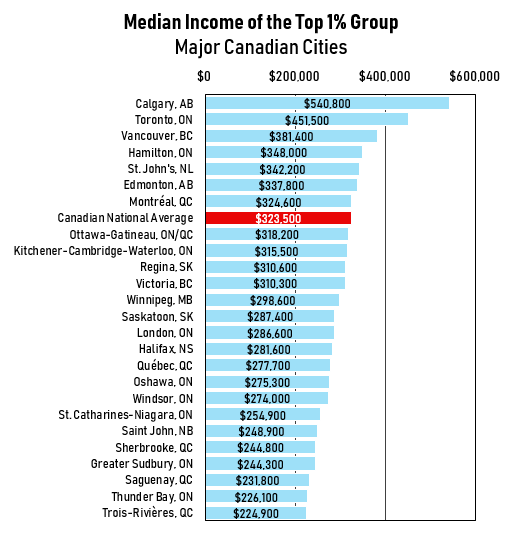

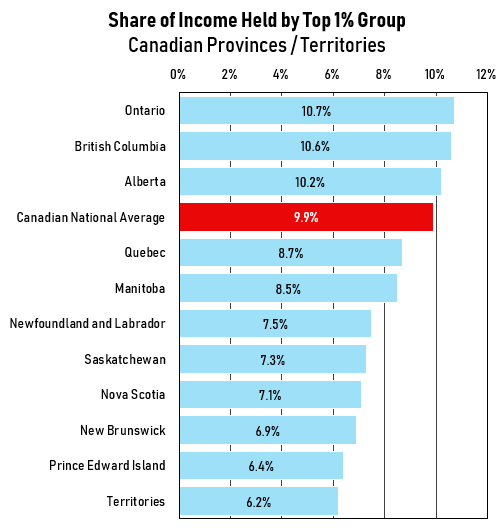

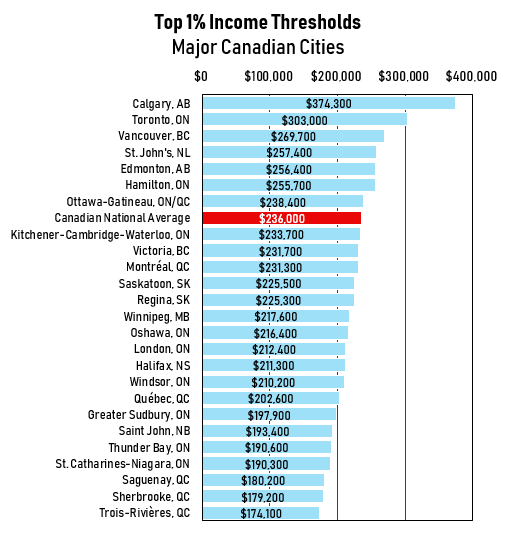

In 2017 the median top 1 Canadian earned an income of 323500 compared to 35100 across all Canadians implying that people in the top 1 earned 92 times more income than the average Canadian. This is done through shady accounting practices or stashing money in offshore accounts in tax-havens like the Caribbean. There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal.

Tax Planning Strategies For High-Income Canadians Registered Education Savings Plan RESP. Each plan defers or mitigates tax obligations in different ways. Using these accounts in the right.

Every Canadian has access to a few different tax-sheltered accounts to help them legally minimize their taxes. Every Canadian has access to a few different tax-sheltered accounts to help them legally minimize their taxes. Make a contribution each year to your RRSP Registered Retirement Savings Plan to the maximum amount allowed ie.

A great example of a safe tax-avoidance strategy is the RRSP Registered Retirement Savings Plans. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. 50 Best Ways to Reduce Taxes for High Income Earners.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article.

Pin On Advanced Financial Planning

Personal Income Tax Brackets Ontario 2020 Md Tax

How To Pay Less Tax In Canada 12 Little Known Tips

High Income Earners Need Specialized Advice Investment Executive

How Can I Reduce My Taxes In Canada

Tax Planning For High Income Canadians

How To Reduce Taxes For High Income Earners In Canada

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

Tfsa Vs Rrsp How To Choose Between The Two 2022 Canadian Money Personal Finance Blogs Personal Finance

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

Manitobans Make 20 More Than A Decade Ago Nearly Double National Growth Rate Census Cbc News